Subject: Question

Kerry, if you’re willing to give us an answer to this, we’d be grateful! We have Quicken 2006. Our bookkeeper, who uses our program, is asking if it is possible to have Quicken prevent or give a warning if, by mistake, she makes an entry with last year’s date. Is that an available option?

Thanks very much,

A:

Because QuickBooks is such a better program, I haven't been using Quicken for a long time. The most recent version I have on any of my computers is Quicken 2003. I just checked the settings available in it and I found the ability to check a box in the Miscellaneous tab of the Register options under Preferences to Notify When Entering Out-of-Date transactions.

(Click on image for full size)

(Click on image for full size)

Checking the Help description of this, we see the following:

Notify options

When Recording Out of Date Transactions

Select this to be warned when you're about to record a transaction for a different year.

I'm sure there is a similar selection in the later versions of Quicken, such as 2006.

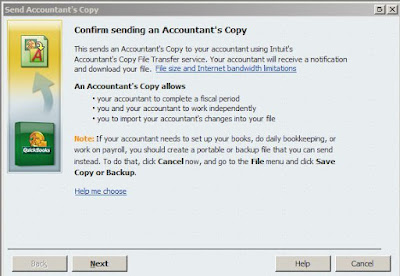

In QuickBooks, there is an option to be notified of any transaction being posted that is more than a selectable certain number of days prior to or after the current date.

(Click on image for full size)

Good luck. I hope this helps.

Kerry Kerstetter

Follow-Up:

Thanks very much, Kerry. You led me to what I needed!