From a Client:

Subject: Using QB on Mac

Hi Kerry,

I’m planning to make a QB upgrade and I’m considering moving to QB for Mac version. Do you work with Mac version of files as well? If not, do you have any clients which have QB for Mac and how do you work with them?

I can still stay on Windows version (i.e. running QB on Windows virtual machine on Mac), if moving to Mac is going to complicate work for you. Please let me know what you think

Thanks

My Reply:

I'm glad you asked about this because I do have some experience, opinions and advice on it.

We do have one corporate client in the San Francisco Bay Area who has always used nothing but Macs, including for her QuickBooks. That was one of the reasons I bought a Mac Mini a few years ago, to be able to work on her QB data without needing to convert it.

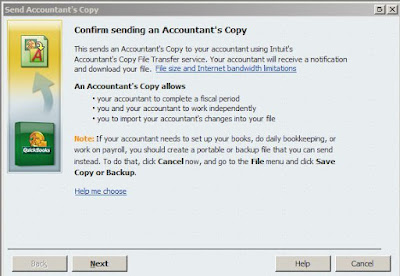

I was extremely disappointed in the features of the Mac version of QB. Many things that I have long taken for granted in the Window version do not exist in the Mac version. The most critical omission is the ability of clients to send me a special Accountant's Review copy of the data and my ability to send my changes back to be imported into the client's master file.

What I discovered was, rather than just having the Mac version of QB copy all of the features of the Windows version, Intuit developed it from the ground up, as they proudly boast. As a computer software pro, you may better understand the logic behind that decision than I can. For my sake, I think it was a stupid decision and I avoid using the Mac version as often as possible.

For a few years, the client would send her Mac QB data file to me and I would have my Mac Mini run the Mac QB program to convert the data file to be compatible with the Windows program. This takes the mini several hours to actually do.

The Mac version of QB does have a feature to allow its data file to be converted to Windows compatible. This is what the client did this past year, saving me a lot of conversion time. However, I am still unable to send her a change file to import; so I sent her an Audit Report and complete General Ledger and she has to manually make the adjusting entries in her file in order to keep her data in sync with what I used on the tax returns.Since we have plenty of Windows machines, I haven't ever tried running Windows on my Mac Mini; so I don't know how well it can handle the Windows version of QB. If you are going to switch everything over to Mac, I would advise trying to run the Windows version of QB on your system, so that we can work more efficiently together with the data files.

If you do have big problems doing that, you can switch to the Mac version and then use it to convert your data file to Windows before sending it to me.

You didn't ask about using the online version of QB, which Intuit is pushing hard in order to generate much more revenue than by selling stand alone programs. However, if you are considering that, I would strongly advise against it. I have a few clients using QB Online and it's even worse than the Mac version.

I hope this info helps. Let me know if you have any other questions or issues to consider.

Kerry

Follow-Up:

Hi Kerry, Thanks for this excellent and detailed explanation! It helps a lot and makes my decision simple - I'm going to upgrade my QB Windows version, and will stick to running it in Virtual Machine on Mac, as I did for the past few years already. It works just fine this way.

BTW, the reason I'm even considering the upgrade is the Intuit's decision to stop supporting online banking access in version 2012 (the one I use) - which seems to me very offensive. We're talking here about forcing users with just 3 years old version of the product to force them into an upgrade!

Thanks

My Response:

The basic bookkeeping functions in QB will work essentially forever. I just worked on a client's books yesterday who is still using the 2007 version.

However, you are correct that Intuit needed a way to motivate users to buy newer versions of the software, so they started a Sunset policy several years ago, under which they cease official support for any version of their program that is more than three years old. As part of this support cut-off, most optional services will also no longer function. It happens most often with Payroll, where clients have had to upgrade to a newer version in order to continue using the QB Payroll utility. Yours is the first case I have heard of where online banking functions have been cut off. I don't use any of the optional QB services myself, so it's good to get this kind of info from others.

As I mentioned in my earlier email, Intuit hasn't been satisfied with the level of sales generated by the three year Sunset policy. A person can buy a desktop version of the program and use it on multiple computers, with multiple company files, for three years before he bumps up against the problem you are having. Their "solution" is the classic SAAS route with their very inferior online program, where they charge a monthly fee per company file.

It could be worse. Luckily, they haven't shortened their Sunset period to one year from the current three, as some other software companies have done to force users to upgrade more frequently.

Good luck. Let me know if you have any problems or questions.

Kerry